What is Cash-Out Equipment Financing?

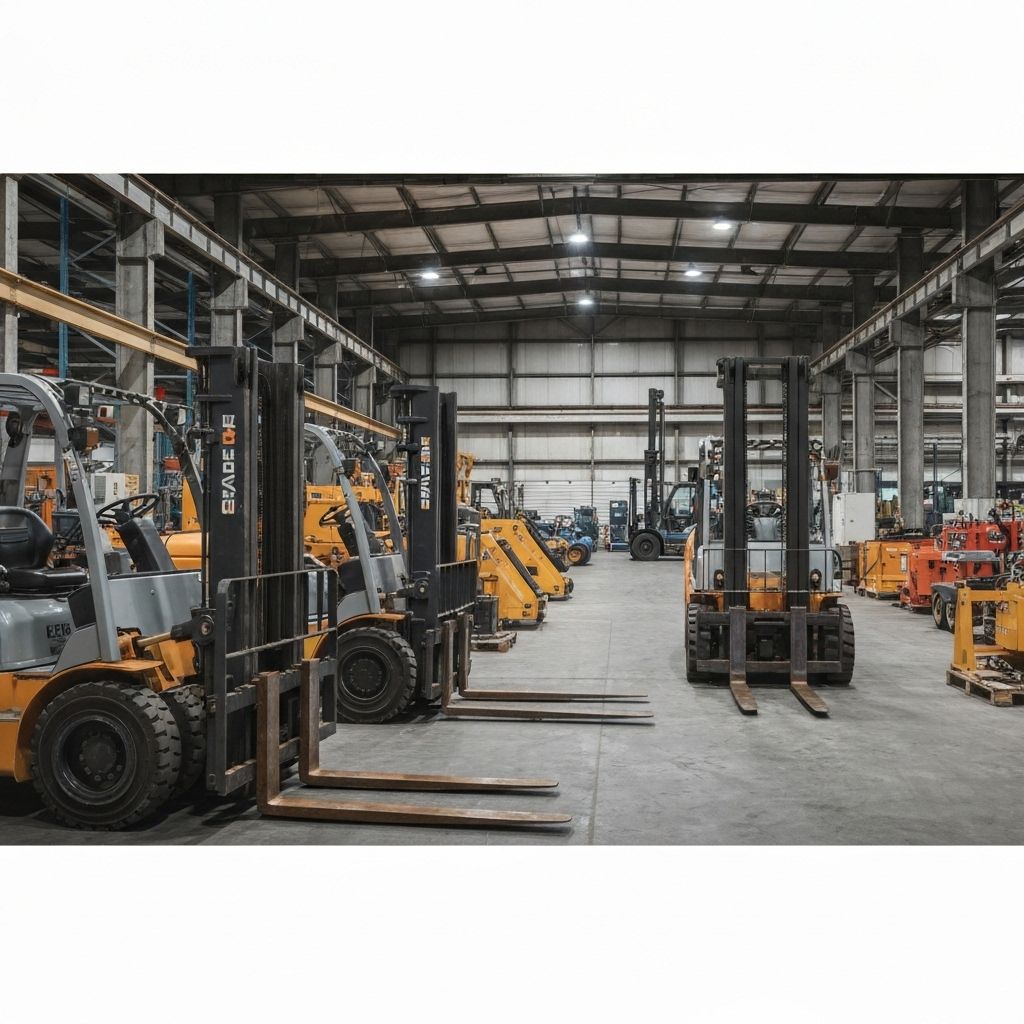

Cash-out equipment financing allows businesses to access the equity built up in their owned equipment by refinancing it. This strategy converts equipment assets into working capital while maintaining use of the equipment for ongoing operations.

How Cash-Out Equipment Financing Works

The process involves a lender providing a loan based on the current market value of your owned equipment. You receive cash equal to 70-90% of the equipment's appraised value, depending on equipment type, condition, and market demand.

Strategic Uses for Cash-Out Proceeds

Fund business expansion, inject working capital, consolidate debt, purchase additional equipment, or invest in marketing and growth initiatives. The flexibility of cash-out financing makes it valuable for various business needs.

Conclusion

Cash-out equipment financing provides a strategic way to unlock capital from your existing assets. By leveraging equipment equity, you can fund growth initiatives while maintaining the operational capabilities that drive your business success.

Sarah Mitchell

Equipment financing specialist with years of experience helping businesses acquire the equipment they need to grow and succeed.